The 2-Minute Rule for Pkf Advisory Services

Table of ContentsUnknown Facts About Pkf Advisory ServicesExcitement About Pkf Advisory ServicesPkf Advisory Services Can Be Fun For AnyonePkf Advisory Services Things To Know Before You BuyThe Only Guide to Pkf Advisory Services

Many people nowadays know that they can not depend on the state for greater than the absolute essentials. Preparation for retired life is a complex company, and there are several choices available. A financial advisor will certainly not just aid filter through the lots of guidelines and item options and assist create a portfolio to maximise your long-term leads.

Acquiring a house is just one of the most costly choices we make and the large majority of us need a home loan. A monetary consultant might conserve you thousands, particularly sometimes similar to this. Not only can they seek the very best rates, they can aid you examine reasonable levels of loaning, make the most of your deposit, and might also find loan providers that would otherwise not be readily available to you.

The Only Guide to Pkf Advisory Services

An economic advisor recognizes exactly how items operate in different markets and will identify feasible downsides for you in addition to the possible benefits, to ensure that you can then make an informed choice concerning where to invest. Once your threat and financial investment evaluations are full, the next step is to check out tax; even one of the most fundamental introduction of your placement can help.

For a lot more challenging arrangements, it might imply moving properties to your spouse or kids to increase their individual allocations instead - PKF Advisory Services. A monetary adviser will constantly have your tax obligation placement in mind when making referrals and point you in the right instructions also in challenging scenarios. Even when your financial investments have actually been implemented and are going to strategy, they need to be kept an eye on in case market developments or abnormal occasions press them off program

They can assess their performance against their peers, ensure that your asset allocation does not come to be altered as markets vary and aid you settle gains as the target dates for your best goals move better. Cash is a complicated topic and there is lots to take into consideration to secure it and maximize it.

The Main Principles Of Pkf Advisory Services

Utilizing a great financial adviser can puncture the buzz to guide you in the ideal instructions. Whether you need general, practical guidance or a specialist with devoted competence, you might discover that in the long term the cash you buy expert guidance will be repaid many times over.

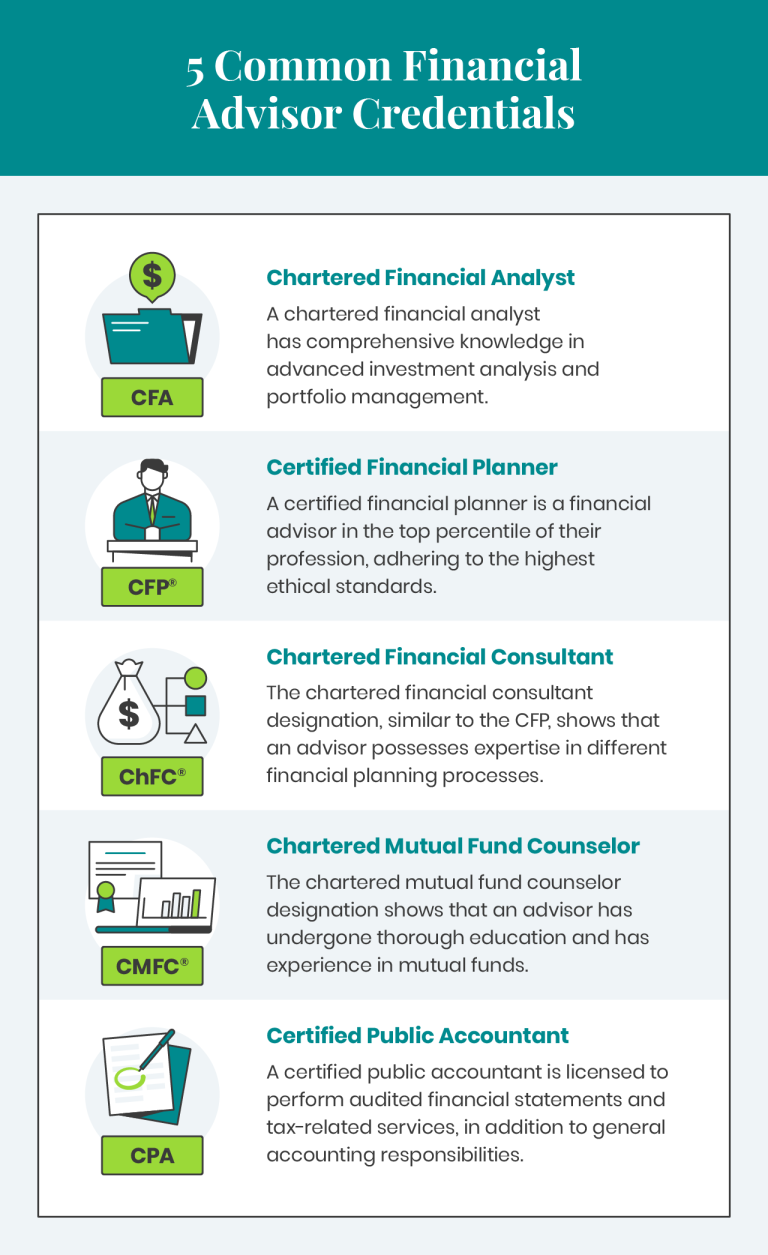

Maintaining these licenses and qualifications requires continual education and learning, which can be expensive and taxing. Financial experts require to stay upgraded with the newest sector fads, policies, and ideal practices to serve their customers properly. Regardless of these difficulties, being a certified and accredited monetary expert supplies enormous advantages, including various occupation opportunities and higher earning potential.

Get This Report about Pkf Advisory Services

Empathy, analytical skills, behavior finance, wikipedia reference and excellent communication are critical. Financial advisors work carefully with customers from varied backgrounds, helping them browse intricate monetary decisions. The capacity to listen, understand their one-of-a-kind demands, and offer tailored advice makes all the difference. Surprisingly, previous experience in financing isn't constantly a requirement for success in this field.

I began my job in company finance, moving and up throughout the company finance structure to refine abilities that prepared me for the role I am in today. My selection to move from corporate finance to personal financing was driven by personal requirements as well as the need to aid the numerous people, households, and small companies I currently offer! Achieving a healthy and balanced work-life equilibrium can be challenging in the early years of an economic consultant's occupation.

The financial advisory profession has a positive overview. This growth is driven by elements such as a you can try this out maturing populace needing retirement preparation and raised recognition of the importance of economic planning.

Financial consultants have the unique capability to make a considerable influence on their customers' lives, helping them accomplish their economic goals and secure their futures. If you're passionate regarding money and helping others, this profession path may be the best fit for you - PKF Advisory Services. To learn more information regarding coming to be an economic expert, download our extensive FAQ sheet

Some Known Questions About Pkf Advisory Services.

It does not include any kind of investment suggestions and does not resolve any private truths and scenarios. It can not be depended on as giving any type of financial investment recommendations. If you would certainly like investment advice concerning your particular facts and circumstances, please get in touch with a competent monetary consultant. Any type of investment includes some level of danger, and different sorts of investments involve varying levels of threat, consisting of loss of principal.

Past performance of any safety, Recommended Reading indices, method or appropriation may not be a sign of future outcomes. The historical and existing info regarding policies, legislations, standards or advantages included in this paper is a recap of details acquired from or prepared by various other resources. It has actually not been separately verified, yet was obtained from resources thought to be dependable.

A financial advisor's most beneficial property is not proficiency, experience, or even the ability to generate returns for clients. It's count on, the foundation of any kind of effective advisor-client partnership. It sets an advisor apart from the competition and maintains clients coming back. Financial specialists across the country we interviewed concurred that count on is the key to constructing enduring, effective relationships with clients.